Financial mathematics, sometimes referred to as quantitative finance, is the field of study that applies mathematical tools to solve problems in finance. It is fundamental to understanding how financial markets operate, assessing risk, and creating models that can guide trading and investment decisions. This article introduces the foundational concepts of financial mathematics, covering everything from basic probability to sophisticated financial instruments, while also shedding light on the limitations and future potential of the field.

Financial Mathematics

To grasp financial mathematics, one must first appreciate the nature of randomness and risk.

Tossing a Die

Consider the simple example of tossing a fair six-sided die. Each face (numbered 1 through 6) has an equal probability of 1/6. This basic idea of equally likely outcomes is foundational in probability theory and serves as a stepping stone toward understanding the more complex probabilistic behavior of financial instruments. The concept of expected value, which in this case is the average of the outcomes (i.e., 3.5), helps illustrate how we think about the average or "fair" result over many trials.

Measure Theory

Measure theory underpins modern probability and financial mathematics. It allows us to rigorously define and work with probabilities, especially when outcomes are continuous rather than discrete. In finance, we often deal with asset prices that move continuously over time. Measure theory gives us the language and tools to handle these changes, particularly through stochastic calculus, which is vital in option pricing models like Black-Scholes.

What is a Fair Price?

A central question in finance is: what is a fair price? In financial mathematics, a fair price is often defined as one that prevents arbitrage -- the opportunity to make a risk-free profit. Fair pricing is closely tied to the concept of "no arbitrage" and leads to the creation of mathematical models that assume markets are efficient and that prices reflect all available information. The concept of a fair price is not static; it evolves with the influx of new data and changing market conditions.

Financial Innovation

Financial innovation refers to the development of new financial instruments, technologies, and strategies. From the creation of derivatives to algorithmic trading, innovation has transformed markets. These advances often rely heavily on mathematical models for valuation and risk assessment. While they create opportunities, they also introduce new complexities and risks, making the study of financial mathematics even more essential.

Randomness in the Stock Market

Markets are influenced by countless factors, making them inherently unpredictable. Two primary schools of thought attempt to navigate this randomness: technical analysis and fundamental analysis.

Technical Analysis

Technical analysis involves analyzing past market data, primarily price and volume, to forecast future price movements. It is based on the belief that historical trading activity can indicate future trends. Tools like moving averages, Bollinger Bands, and relative strength indicators are all rooted in mathematical computations. However, critics argue that technical analysis may be prone to confirmation bias and lacks a theoretical foundation in probability.

Fundamental Analysis

In contrast, fundamental analysis evaluates a company's intrinsic value based on its financial statements, management quality, industry position, and economic conditions. This approach is grounded in economic theory and assumes that stock prices will eventually reflect the underlying business performance. Mathematical models, including discounted cash flow analysis, are used to estimate value and compare it to the current market price.

Buy and Sell the Future

Financial mathematics plays a critical role in contracts involving future transactions. These include options, futures, and swaps.

Option to Buy or Sell Stocks at a Fixed Price in the Future

An option gives the holder the right, but not the obligation, to buy (call) or sell (put) an asset at a predetermined price on or before a specified date. The pricing of options is a cornerstone of financial mathematics. The famous Black-Scholes model uses stochastic differential equations to determine the fair value of European options. Understanding how volatility, time to maturity, and other factors influence option prices is key to both trading and risk management.

Contract to Buy at a Fixed Price in the Future

Futures contracts obligate the buyer to purchase, and the seller to sell, an asset at a set price on a future date. These are standardized and traded on exchanges. The valuation of futures relies on arbitrage arguments and considers the cost of carry (storage, interest rates, etc.). Futures are widely used for hedging and speculation.

Swaps Based on the Values of Stocks, Currency, or Other Valuable Assets

Swaps are derivative contracts where two parties exchange cash flows or other financial instruments. The most common types are interest rate swaps and currency swaps. For instance, a company may swap a fixed interest rate for a floating rate to hedge against interest rate fluctuations. The valuation of swaps involves present value calculations and projections of future rates or asset prices, making financial mathematics essential in structuring and pricing these agreements.

Financial Tools

Financial mathematics provides a toolkit for understanding and managing complex instruments and market behaviors.

Financial Derivatives and Relation to Calculus

Derivatives are financial instruments whose value is derived from an underlying asset. The term also alludes to the mathematical concept of derivatives in calculus, which measure the rate of change. Calculus is integral in modeling price changes and determining sensitivities, known as the "Greeks" in options trading: Delta, Gamma, Theta, and Vega. These measure how option prices change with respect to various factors.

Mathematical Models to Determine Price of Financial Derivatives

Various models exist for pricing derivatives, with the Black-Scholes model being the most famous. It assumes a geometric Brownian motion for asset prices and uses partial differential equations to arrive at a closed-form solution for European options. More advanced models incorporate jumps, stochastic volatility, or numerical methods like Monte Carlo simulation and binomial trees.

To Work Out What the Premiums Should Be

Premiums for options and insurance products must reflect the expected risk and return. This involves calculating the expected payoff and discounting it back to the present value, often under a risk-neutral measure. These calculations ensure that the seller of the derivative is adequately compensated for the risk undertaken.

Challenges in Financial Mathematics

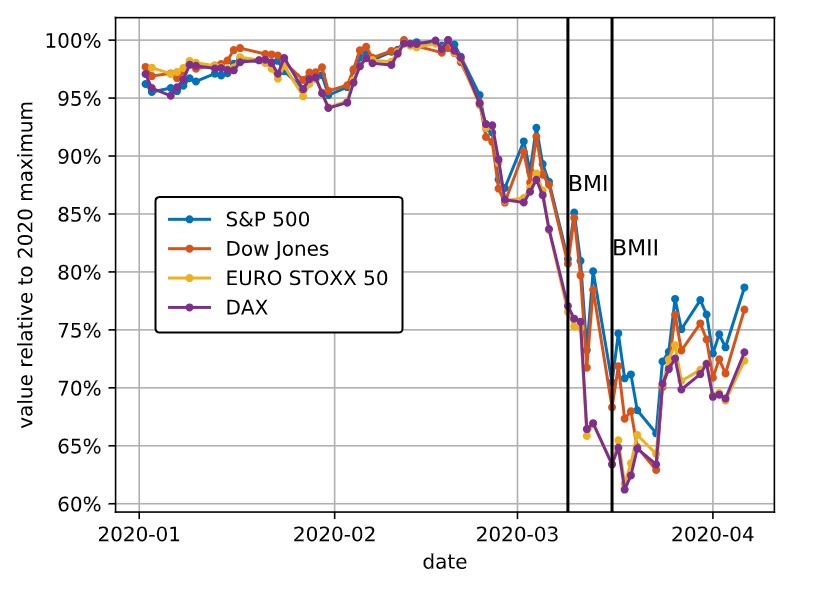

Many Market Behaviors That the Models Cannot Explain

Real markets exhibit phenomena like fat tails (extreme events), volatility clustering, and investor irrationality - features that standard models like Black-Scholes often fail to capture. For example, the 2008 financial crisis exposed the inability of models to account for systemic risk and cascading failures.

Many Traders Think That the Models Are Wrong: Examples

Prominent traders like Nassim Nicholas Taleb have criticized mainstream financial models for underestimating rare but impactful events, which he terms "Black Swans." Similarly, the collapse of Long-Term Capital Management in 1998, despite employing Nobel laureates and sophisticated models, illustrates how theoretical assumptions can fail in practice. The models assumed normal distributions and underestimated the likelihood of extreme market movements.

Future Outlook

The future of financial mathematics lies in blending traditional models with insights from behavioral finance, data science, and machine learning. As computational power increases, models can become more adaptive and data-driven. However, the human element of fear, greed, and decision-making under uncertainty remains a wildcard that no model can fully capture.

Conclusion

Financial mathematics is a powerful discipline that bridges the gap between theory and practice in financial markets. From understanding the probability of a die toss to modeling complex derivatives, it provides the analytical foundation for navigating the intricate world of finance. Despite its challenges and limitations, continued innovation in this field holds promise for more robust, realistic, and inclusive financial systems.

References

What is financial mathematics?

Randomness in the stock market

Selling the future

You can learn these concepts and more at Dr Hock's maths and physics tuition.